A bonded business has obtained a surety bond, which acts as a financial guarantee that protects customers if the business fails to meet its obligations. This means customers receive a refund if the company fails to deliver services as promised, commits fraud, or causes damage.

Understanding what “bonded” means is crucial for both business owners and consumers. For businesses, bonding opens doors to bigger contracts and builds customer trust. For consumers, it provides protection when hiring services like contractors, cleaners, or movers.

Many people confuse bonding with insurance, but they work differently. This guide breaks down everything you need to know about business bonding in simple terms. You’ll learn how bonds work, why they matter, and how to spot legitimate bonded businesses.

What Does “Bonded” Actually Mean?

The Simple Definition

When a business says it’s “bonded,” it means they’ve purchased a surety bond. Think of this as a three-way promise between the industry, its customers, and an insurance company.

Here’s how it works: The business pays a premium to get the bond. If they break their promise to customers, the insurance company pays the customer back. Then the business must repay the insurance company.

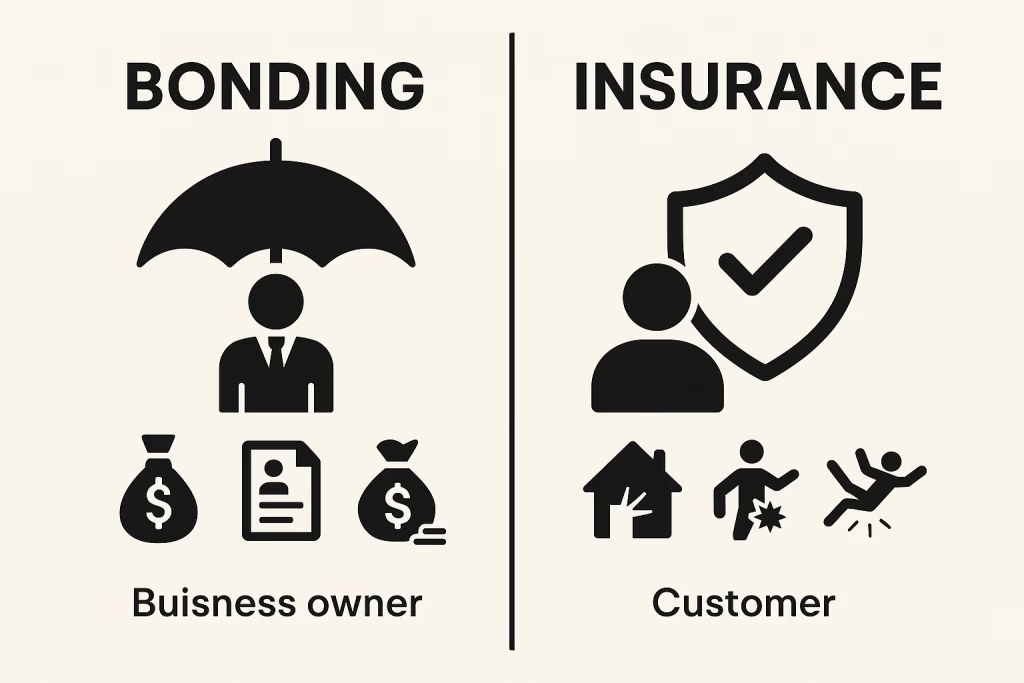

Bonding vs. Insurance: The Key Difference

This distinction confuses many people. Insurance protects the business when bad things happen to it. Bonding protects customers when the company does bad things.

Comparing bonding vs insurance protection for businesses and customers

Insurance Example: A contractor’s truck gets stolen. Their insurance pays to replace it.

Bonding Example: A contractor takes your deposit but never shows up. The bond pays you back.

| Aspect | Insurance | Surety Bond |

| Who’s Protected | The business | The customer |

| What It Covers | Accidents, theft, damage to business | Business not fulfilling obligations |

| Payment Method | Claim filed, insurance pays the business | Claim filed, surety pays customer, business reimburses surety |

Who Needs to Be Bonded?

Different industries have different bonding requirements. Some bonds are required by law, while others are optional but helpful for business.

industries that require bonding with typical bond amounts

Common Industries That Need Bonds:

- General contractors and specialty trades

- Cleaning services and janitorial companies

- Auto dealers and repair shops

- Freight brokers and logistics companies

- Notaries public and court reporters

The specific requirements vary by state and industry. Some require bonds before issuing business licenses. Others only need bonds for government contracts.

How Business Bonding Works

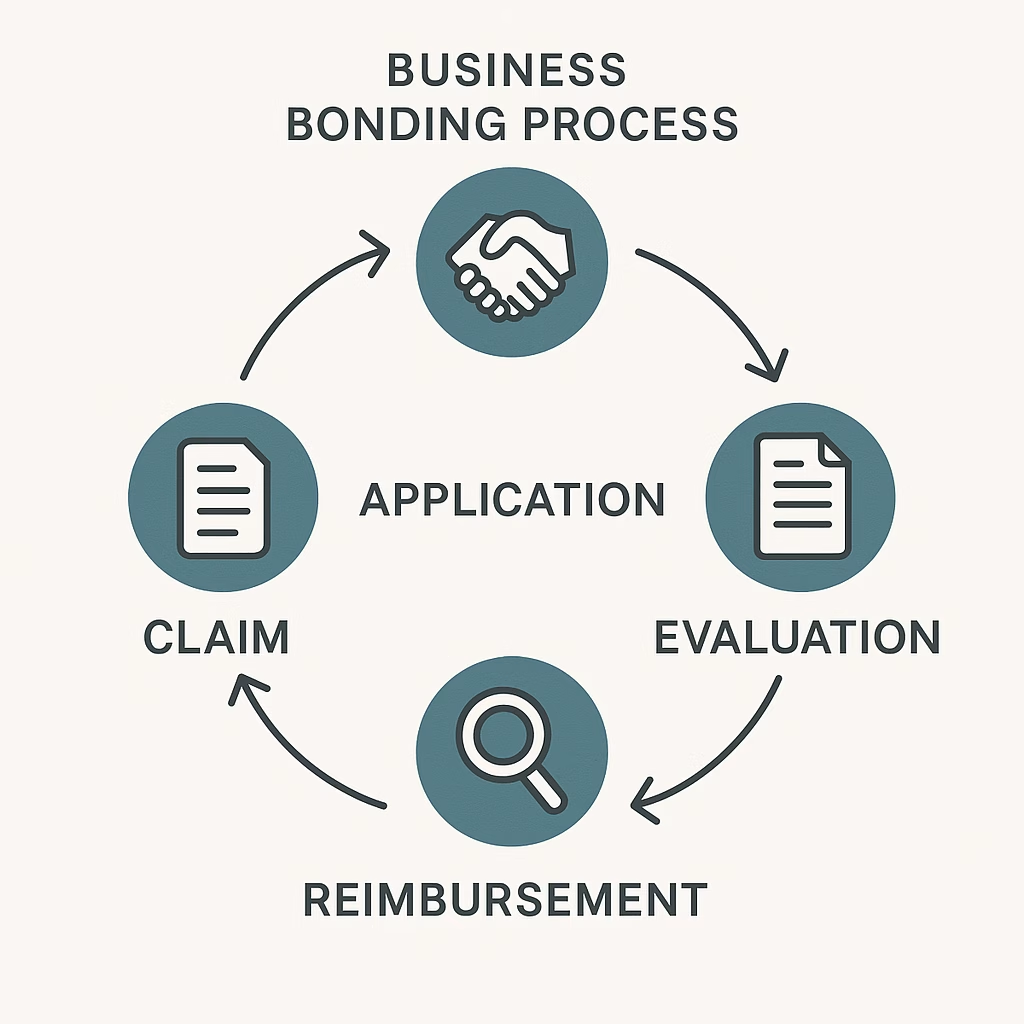

The Application Process

Getting bonded isn’t automatic. Surety companies check your business carefully before issuing a bond. They look at three main factors: your credit score, financial statements, and business experience.

4-step bonding process from application to claim resolution

Step 1: Choose Your Bond Type

Different situations need different bonds. License bonds let you operate legally. Performance bonds guarantee you’ll complete projects. Fidelity bonds protect against employee theft.

Step 2: Submit Your Application

You’ll need personal and business credit reports, financial statements, and references. The surety company wants proof that you can pay back any claims.

Step 3: Pay Your Premium

Bond costs typically range from 1% to 15% of the bond amount annually. Good credit gets you lower rates. A $10,000 bond might cost $100-$1,500 per year.

Understanding Bond Amounts

The bond amount isn’t what you pay – it’s the maximum the surety will pay for claims. Standard amounts range from $5,000 for small service businesses to millions for large construction projects.

Important: You’re responsible for paying back the surety company for any claims they pay out. Bonds don’t work like insurance, where you file a claim and walk away.

When Claims Happen

If a customer files a claim against your bond, the surety company investigates. They’ll contact you for your side of the story. If the claim is valid, they pay the customer and then come after you for reimbursement.

Most claims involve: incomplete work, poor artistry, failure to pay subcontractors, or theft by employees. Maintaining good business practices can prevent most claims.

Why Being Bonded Matters for Your Business

Building Customer Trust

The word “bonded” immediately signals trustworthiness to consumers. It shows you’ve been vetted by a third party and stand behind your work. This trust translates into more sales and higher prices.

Many customers specifically search for “bonded” service providers. They understand it means extra protection for their money. This is especially true for expensive services, such as home renovations or commercial cleaning contracts.

Access to Better Opportunities

Government Contracts: Most government work requires bonding. Federal projects over $150,000 need performance and payment bonds. State and local requirements vary, but often start much lower.

Commercial Work: Large companies prefer bonded vendors. It reduces their risk and shows professionalism. Property management companies often require bonds for maintenance contractors.

Higher Contract Values: Bonding capacity determines how large projects you can bid on. More bonding opens doors to bigger, more profitable work.

Industry-Specific Benefits

Construction: Performance bonds guarantee project completion. Payment bonds ensure subcontractors get paid. These bonds are required for most public projects and many private ones.

Service Providers: Fidelity bonds protect customers from employee theft. This is crucial for businesses with access to homes or offices, like cleaning services, security companies, or repair technicians.

Transportation: Freight brokers need $75,000 bonds to operate legally. Motor carriers often need bonds for certain types of cargo or routes.

Real Business Impact

Consider two cleaning companies bidding for an office building contract. Company A costs $500 less per month but isn’t bonded. Company B is bonded and insured. Most property managers choose Company B despite the higher costs.

The bonding shows that Company B takes its business seriously. It also means the property manager won’t lose money if something goes wrong. This protection justifies the higher price.

Common Mistakes and How to Avoid Them

The “Bonded and Insured” Confusion

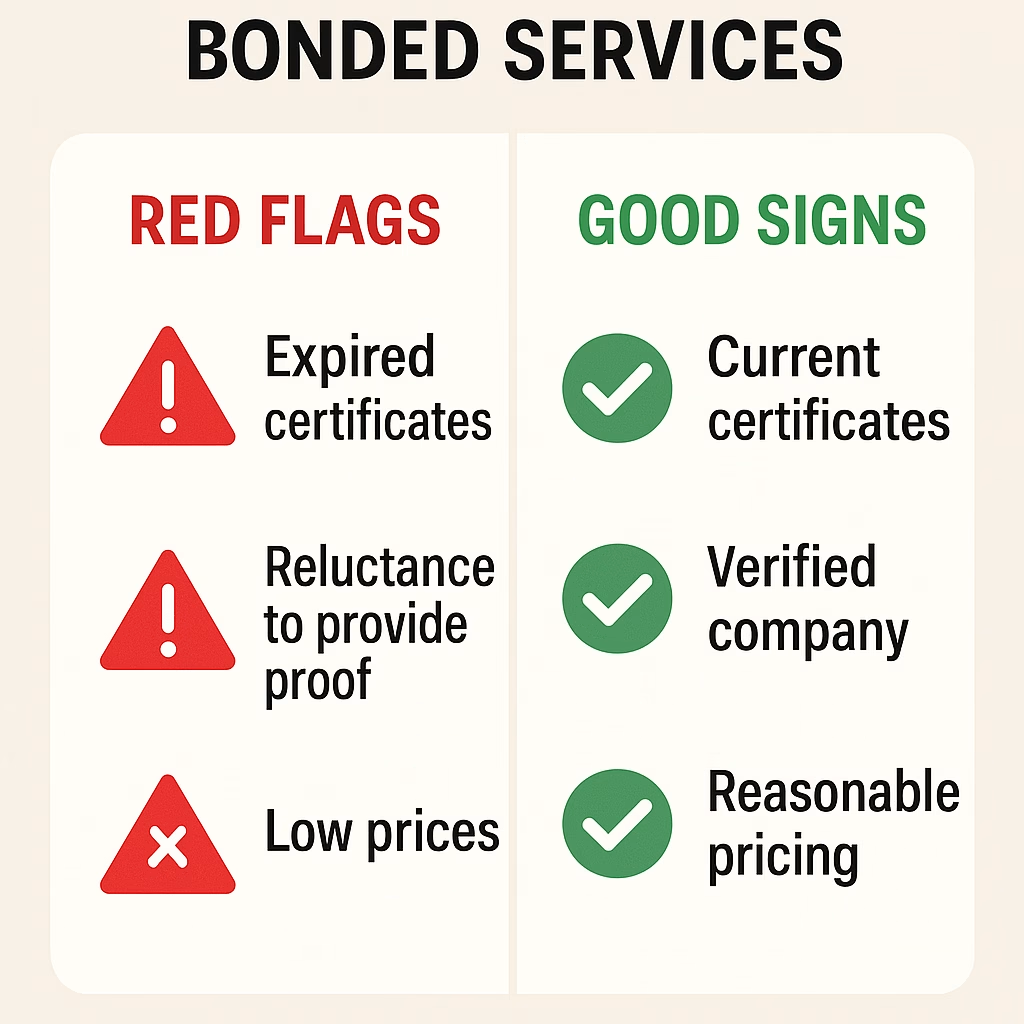

Many businesses advertise as “bonded and insured” without understanding what this means. Some use fake certificates or let policies lapse. Always verify coverage directly with the insurance or surety company.

Red Flags to Watch:

- Reluctance to provide certificate numbers

- Certificates with typos or poor formatting

- Coverage amounts that seem too good for the business size

- Expired or soon-to-expire certificates

Red flags and good signs when hiring bonded services

Choosing the Wrong Bond Amount

Under-bonding saves money upfront but limits business opportunities. You can’t bid on projects larger than your bond capacity. It also provides less customer protection, reducing trust.

Over-bonding wastes money on unnecessary premiums. Calculate your actual needs based on typical project sizes and industry requirements.

Hidden Costs and Renewal Issues

Bond premiums can increase at renewal, especially if you’ve had claims or credit problems. Some companies lock in rates for multiple years to avoid surprises.

Watch for: annual fees, processing charges, and cancellation penalties. Get quotes from multiple sureties to compare total costs, not just premiums.

How to Get Bonded Successfully

Choose the Right Surety Partner: Work with agents who understand your industry. They can guide you to the best bond types and help with applications.

Prepare Financial Documents: Gather tax returns, financial statements, and bank records. Clean credit and a good credit history can lead to better rates and faster approvals.

Maintain Good Relationships: Pay premiums on time and avoid claims when possible. Long-term relationships with sureties often result in better terms and higher bonding capacity.

Key Documents You’ll Need:

- Personal and business credit reports

- Three years of tax returns

- Current financial statements

- Business licenses and registrations

- Project references and work history

Conclusion

Being bonded means having a financial guarantee that protects your customers if you are unable to meet your obligations. It’s different from insurance because it protects them, not you. This protection builds trust, opens doors to better contracts, and shows you run a professional business.

The bonding process involves credit checks, financial review, and ongoing premiums. While it incurs an upfront cost, bonding typically pays for itself through increased sales and access to larger projects.

Don’t confuse bonding with insurance or try to cut corners with inadequate coverage. Work with experienced agents, maintain good credit, and choose bond amounts that match your business needs.

Whether you’re a business owner considering bonding or a consumer hiring services, understanding these basics protects everyone involved. Bonding isn’t just about meeting legal requirements – it’s about building lasting business relationships based on trust and financial security.