Nearly six in ten Americans still live paycheck to paycheck despite the strongest labour market in decades. A structured budget flips that script by clarifying where every dollar should go, unlocking higher savings, lower stress, and steadier credit health. Follow the five stages below—income and expense tracking, selecting a budgeting architecture, setting priorities, automating reviews, and troubleshooting common hurdles—to move from money chaos to control within one quarter.

Quick-Answer Summary

Managing personal finances requires:

- Calculating after-tax income and every recurring or irregular expense.

- Picking a budgeting framework (50/30/20, zero-based, envelope, or pay-yourself-first).

- Ranking goals with an emergency-first, debt-second, growth-third pyramid.

- Automating transfers and running weekly “money dates” for 15-minute progress checks.

- Adjusting for irregular income, inflation spikes, or unexpected bills.

Consistent budgeting cuts money-related anxiety by providing predictability and decision relief, benefits repeatedly observed in behavioral-finance studies.

What Is Personal Finance Management?

Personal finance management is the deliberate planning, organizing, and monitoring of cash inflows and outflows to meet day-to-day obligations while reaching future goals. It’s about taking control and understanding where your money is going, empowering you to make informed decisions. It rests on five pillars:

- Income management – cataloguing every paycheck, side-hustle deposit, dividend, or benefit.

- Expense control involves separating needs, wants, and stealth costs, such as subscription renewals.

- Savings formation – building reserves for emergencies and long-term targets.

- Debt reduction – trimming high-interest balances that erode wealth.

- Investment planning – converting surplus cash into appreciating assets over time.

A written plan turns abstract intentions into daily actions, replacing uncertainty with clarity and reducing financial stress that 72% of Americans say weighs on their mental health.

Step 1: Capture Your Complete Financial Picture

Audit All Income

List net salary, freelance payments, bonuses, passive income (dividends, rent), and irregular windfalls like tax refunds. Use net figures so your budget mirrors spendable cash.

Track Expenses in Three Layers

| Layer | Examples | Tracking Tip |

| Fixed | Rent, insurance, loan payments | Pull the last three months of bank statements |

| Variable | Groceries, utilities, fuel | Snap receipts into an expense app daily |

| Irregular | Holidays, repairs, annual fees | Average prior-year totals and divide by 12 |

Run a “financial forensics” sweep to uncover hidden drains: unused subscriptions, ATM fees, and impulse micro-spends.

Step 2: Choose Your Budgeting Architecture

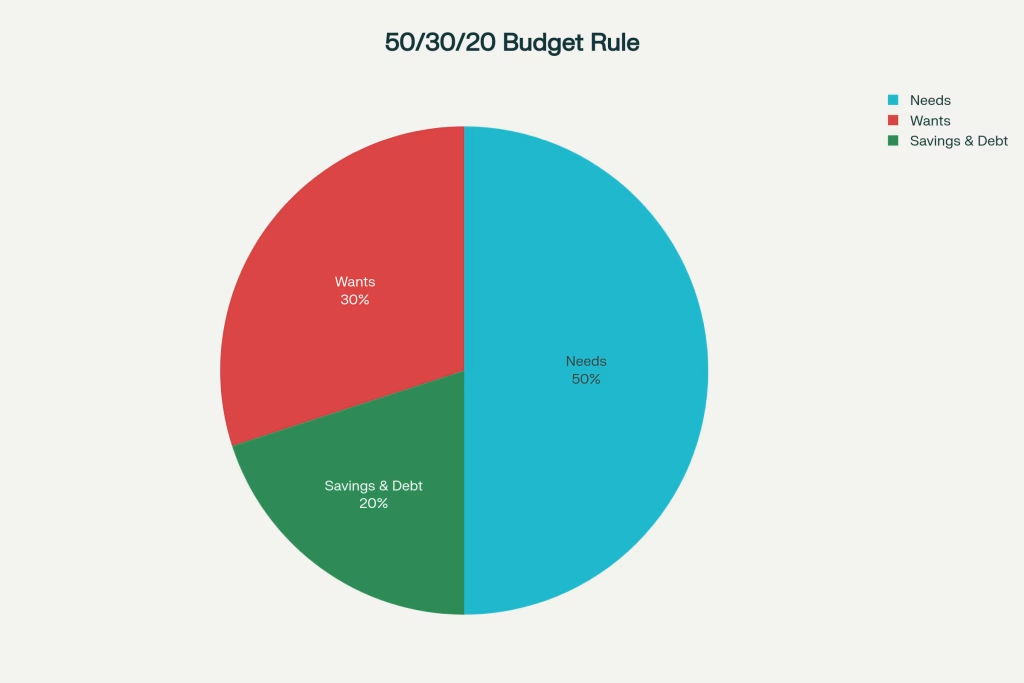

50/30/20 Rule – Fast Start

Allocate 50% of net pay to needs, 30% to wants, and 20% to savings or debt. Adjust to 60/20/20 if housing costs dominate, or 40/30/30 for high earners seeking aggressive savings.

The 50/30/20 Rule: A Simple Framework for Personal Finance Management

Zero-Based Budget – Dollar-Perfect

Assign every dollar a task until income minus outgo equals zero. Ideal for detail lovers or irregular earners who crave precision.

Envelope Method 2.0 – Digital Buckets

Create virtual envelopes within apps like Goodbudget to cap category spending. Combine with one cash envelope for discretionary purchases to curb swipe temptation.

Pay-Yourself-First – Automation Heavy

Route 10-20% of pay straight to savings and investments on payday, then live on what remains. Works best for salaried households struggling to save consistently.

Take the free “budget personality quiz” embedded later to match the method to the lifestyle.

Step 3: Set Smart Financial Priorities

The Financial Priority Pyramid

- Security Layer – Starter emergency fund of $1,000 and capturing employer 401(k) match.

- Stability Layer – Pay off debt above 10% APR and grow emergency reserves to six months of expenses (≈$35,000 for the median U.S. household).

- Growth Layer – Extra retirement contributions, taxable investments, major-purchase sinking funds.

Debt Payoff Playbook

- Avalanche – Attack the highest-interest balance first to minimize total interest.

- Snowball – Knock out smallest balances for psychological wins; switch to avalanche once momentum builds.

Step 4: Track and Automate for Consistency

- Automatic transfers – Schedule savings and bill payments within 24 hours of payday to prevent “leftover money syndrome.”

- Weekly money date – Fifteen-minute Sunday review: compare category spend vs. plan, scan upcoming bills, and celebrate one win.

- Monthly dashboard – Measure savings-rate %, debt-to-income ratio, and budget variance (aim to stay within ±5%).

- Best-fit tools

- Free: Mint (auto categorization), EveryDollar (zero-based), NerdWallet template.

- Paid: YNAB for envelope/zero hybrid, Tiller for spreadsheet lovers (auto bank feeds).

Step 5: Troubleshoot Real-World Challenges

Irregular Income

Base budget on your lowest earning month; treat surplus as “bonus”, split 50% savings, 25% debt, 25% discretionary to avoid feast-and-famine cycles.

Overspending

Freeze the leaky category, transfer funds from a lower-priority envelope, and annotate the trigger to prevent repeats next month.

Economic Shocks

During inflation spikes, audit subscriptions, renegotiate insurance, and shift grocery brands. A high-yield savings account currently pays up to 5.00% APY—13 times the national average—so park your emergency fund where it earns.

Life Transitions

Bundle finances before marriage with joint “household” and individual “personal” accounts to balance transparency and autonomy. For new parents, add childcare and medical deductibles to the needs bucket and increase emergency coverage to nine months.

Advanced Optimization

- Credit lift strategy – On-time payments (35% of score) and sub-30% utilization (30% of score) driven by a disciplined budget can raise FICO scores markedly within a year.

- Tax-efficient budgeting – Direct HSA contributions with pre-tax dollars, then reimburse yourself later for a triple tax win.

- Investment integration – Automate monthly index-fund buys (dollar-cost averaging) and rebalance quarterly to original allocation bands.

Building Sustainable Habits

Adopt the 1% improvement method: raise your savings rate or cut one expense category by a single percent each month. Minor compounding tweaks outperform sporadic austerity.

For couples, hold a 30-minute monthly money meeting: review goals, re-align on big purchases, and document next-month action items to cut conflict rates tied to finances.

Teach children early: allocate allowance into save-spend-give jars to build lifelong money mindfulness.

90-Day Quick-Start Plan

| Timeline | Key Actions |

| Week 1 | Track every expense; total net income; pick a budgeting method |

| Weeks 2-4 | Build first budget; open high-yield savings; automate transfers |

| Weeks 5-6 | Hold first money date; plug overspending; set $1,000 emergency target |

| Weeks 7-8 | Launch debt avalanche or snowball; adjust 50/30/20 percentages |

| Weeks 9-10 | Add retirement auto-contributions; draft holiday/seasonal sinking fund |

| Weeks 11-12 | Review metrics (savings rate, DTI, budget variance); schedule quarterly audit. |

Stick to this roadmap and you will own a functional budget, a funded emergency account, and a repeatable review habit in just three months.

Frequently Asked Questions

How much should I save each month?

Begin with 10% of take-home pay and edge upward by 1% quarterly until you hit 20% or higher.

Should I eliminate debt or build savings first?

Secure a $1,000 emergency buffer, then focus excess cash on any debt above 10% APR while making minimums elsewhere.

How often should I revisit my budget?

Run a weekly 15-minute money date for quick course corrections and a deeper monthly analysis to recalibrate categories.

What if housing alone eats over 50% of income?

Shift to a 60/20/20 model temporarily, diverting extra funds to essentials until you can lower housing costs or boost income.

Can budgeting raise my credit score?

Yes. On-time payments and lower balances driven by a realistic budget directly influence 65% of FICO scoring factors.

Key Takeaway

A budget is not a restriction—it’s your financial GPS. Map where you are, plot where you want to go, and let automated checkpoints keep you on course. Within 90 days, diligent tracking, prioritized goals, and minor habit tweaks can replace paycheck-to-paycheck stress with lasting financial confidence.