Money can be easy to manage. The 50/30/20 budget rule is simple. It has three parts. Millions use it. You can too.

You can earn $2,500 or $7,500 each month. This rule works for all. Anyone can do it. Income level doesn’t matter.

What Is the 50/30/20 Budget Rule?

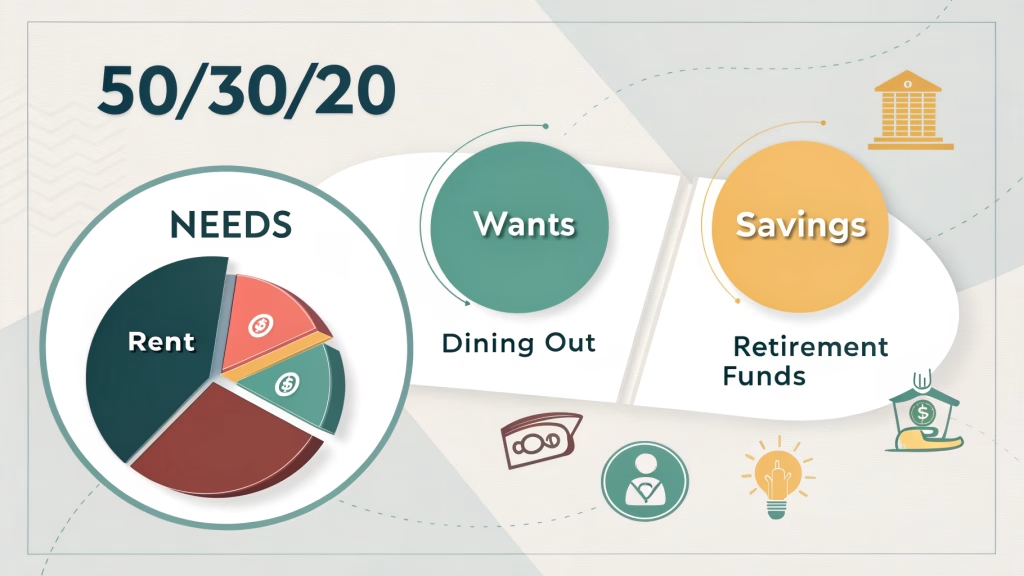

This rule splits your pay into three parts. You use 50% for needs. You use 30% for wants. You use 20% to save. Elizabeth Warren made this rule famous. She wrote a book about money.

This works well. It helps with today and tomorrow. You don’t need to be smart about money. It’s easy to use. It’s also flexible.

Your pay after taxes is key. This is money in your bank. You split it three ways. Each way helps your life.

The Needs Part With Real Examples

Needs get 50% of your pay. These are things you must have. This includes rent, power bills, food, getting around, and insurance. Think of these as basic life needs.

Let’s look at a real example. You earn $4,000 each month after taxes. Your needs get $2,000. This might be $1,200 for rent, $150 for power, $400 for food, $200 to get around, and $50 for insurance.

Your home costs the most. You might pay $1,000 to $1,500 in most places. Food costs $300 to $500 for most people. Getting around costs differ by where you live.

Be honest about needs. Cable TV isn’t needed. Basic internet for work might be. Fancy food isn’t needed. Good food is needed.

The Wants Part With Real Examples

Wants get 30% of your pay. This is fun money. It covers eating out, shows, hobbies, trips, and shopping. Wants make life fun. They aren’t needed to live.

Real examples show different wants. Someone earns $3,500 each month. They get $1,050 for wants. They might spend $400 eating out, $200 on shows, $250 on hobbies, and $200 on other shopping.

Your wants show what you like. Some people like trips. They save $300 each month for vacation. Others like eating out or costly hobbies like photos or golf.

Wants need the most control. These feel needed when you want them. Clear limits help you have fun but stay in budget.

The Savings Part With Examples

Twenty percent of your pay goes to savings. This also pays extra debt. This part builds your future. It includes emergency funds, retirement money, and extra debt payments.

Real examples show different ways to save. Someone earns $5,000 each month. They save $1,000 total. They might put $400 in emergency savings, $400 in retirement, and $200 for extra house payments.

Your emergency fund should cover 3-6 months of costs. If monthly needs equal $2,000, aim for $6,000-12,000 in emergency savings. This helps with job loss, doctor bills, or big repairs.

Retirement savings include 401k money and other long-term savings. Small amounts grow big over time. Steady savings matter more than big one-time amounts.

Full Budget Examples at Different Pay Levels

These examples show how the rule scales. It works if you earn $30,000 or $90,000 per year.

At $2,500 monthly pay, your budget gives $1,250 for needs, $750 for wants, and $500 for savings. This tight budget needs care but still allows some fun and steady savings.

Higher earners at $6,500 monthly can give $3,250 for needs, $1,950 for wants, and $1,300 for savings. More money means more choices but keeps the same balance.

Step by Step Setup Guide

Start by figuring your monthly pay after taxes. Look at pay stubs or bank records.

Next, track spending for one full month. Use bank records, credit cards, or budget apps to sort costs. Don’t judge yet. Just get real data about habits.

Sort each cost as needs, wants, or savings. Be honest about what goes where. Some costs might surprise you.

Set up auto transfers for savings. This means you save first before spending. Many banks do this on set dates each month. You can set your account to move money to savings on a certain date each month. This ensures steady savings without thinking about it.

Common Budget Errors and How to Fix Them

Many people struggle with this rule due to common errors. The biggest error is using gross pay instead of after-tax pay. This can lead to thinking you have more money, causing overspending and stress.

Another error is calling wants “needs.” While exercise is important, a fancy gym isn’t needed. Also, a $200 monthly car payment for a luxury car is more than basic transport needs. These errors can lead to overspending on wants, leaving less for savings and causing money strain.

Being too strict with percentages causes problems in high-cost areas. Someone in San Francisco might need 60% for housing alone. This requires changing to a 60/25/15 split.

Poor tracking ruins even good budgets. Set weekly money meetings with yourself to check spending and adjust.

When to Change the 50/30/20 Rule

Standard examples don’t work for everyone. High-cost areas often need changes like 60/25/15 or even 70/20/10 splits.

People with big debt might use 50/20/30 for a while. This puts extra money toward debt. This clears debt faster but requires cutting fun spending.

Lower-income people sometimes need 70/20/10 splits when basic needs take most pay. This isn’t ideal long-term, but it’s a start while working toward higher pay.

Tools for 50/30/20 Budget Success

Modern tools make this rule easier to use. Budget apps made for this method auto-calculate percentages and track spending.

Spreadsheet templates give structured formats for manual tracking. Many banks offer auto savings features that move set amounts on certain dates.

Multiple bank accounts help keep categories separate. To avoid mixing funds, consider separate accounts for needs, wants, and savings.

Real Benefits From Using This Rule

People who follow this rule report less money stress and clearer money choices. The simple structure stops decision fatigue about spending.

This method builds money discipline without extreme sacrifice. You still enjoy fun spending while steadily saving for future goals.

The balanced approach prevents both overspending and extreme saving. It lets you cover basic needs, enjoy some wants, and build wealth at once.

Money security improves as emergency funds grow and retirement savings build up. Small, steady actions compound into big economic progress over months and years.

Your money stress drops when you know exactly how much you can spend in each part. This clarity leads to confident money decisions and better sleep at night.

This rule gives a practical framework for adapting to changing situations, keeping money balance, and building long-term wealth.

More Real Budget Examples

Let’s see more examples at different pay levels. These show how flexible this rule is.

Example 1: $3,000 Monthly Pay

- Needs: $1,500 (rent $900, utilities $100, food $350, transport $100, insurance $50)

- Wants: $900 (eating out $300, entertainment $200, hobbies $200, misc $200)

- Savings: $600 (emergency fund $300, retirement $200, extra debt $100)

Example 2: $5,500 Monthly Pay

- Needs: $2,750 (rent $1,600, utilities $150, food $500, transport $300, insurance $200)

- Wants: $1,650 (eating out $500, entertainment $400, hobbies $400, travel fund $350)

- Savings: $1,100 (emergency fund $500, retirement $400, investments $200)

Example 3: $8,000 Monthly Pay

- Needs: $4,000 (mortgage $2,200, utilities $200, food $700, transport $500, insurance $400)

- Wants: $2,400 (eating out $600, entertainment $500, hobbies $500, luxury items $800)

- Savings: $1,600 (emergency fund $600, retirement $600, investments $400)

Tips for Success

Start small and build habits. Don’t try to be perfect right away. Small changes add up over time.

Review your budget monthly. Life changes, and your budget should too. Adjust as needed.

Use the envelope method. Put cash in envelopes for each category. When it’s gone, you’re done spending in that area.

Track everything for the first month. This shows where your money really goes. You might be surprised.

Celebrate small wins. When you stick to your budget for a week, reward yourself within your wants category.

Find an accountability partner. Share your goals with someone you trust. Check in with them monthly.

Common Questions Answered

What if my needs are more than 50%? This is common in high-cost areas. Adjust to 60/25/15 or find ways to reduce needs like getting roommates or moving.

Can I skip the wants category? You can, but it’s not wise. Having some fun money prevents budget burnout and overspending later.

What counts as an emergency? Job loss, medical bills, car repairs, home repairs. Not vacations or shopping sprees.

How fast should I build my emergency fund? Aim for $1,000 first, then work toward 3-6 months of expenses. This might take 1-2 years.

Should I pay debt or save first? Pay minimum debt payments in the needs category. Use the savings category for both extra debt payments and emergency fund building.

This simple rule changes how you think about money. It makes complex decisions easy. Start today with your next paycheck.